In the following article I will show you seven reasons why it is interesting to invest a part of your portfolio in gold.

#1 - Gold is money

This was already said by John Pierpont Morgan, who added that everything else is a loan. A bank bill is nothing more than a promissory bill from a central bank that promises a corresponding countervalue. But that equivalent value is fleeting, as current inflation shows.

In the case of central bank money, a total loss can occur. One thinks of state bankruptcies such as in Argentina.

Gold, on the other hand, is the safest money in the world.

Gold is durable and cannot be easily destroyed. The precious metal is easily divisible. This makes it easy to carry, for example as a coin.

Even a bar weighing one kilogram can be transported without any problems. It is no larger than a smartphone. Gold is a very dense metal.

It can be subdivided into any number of small pieces. Each of these coins or pieces has the same purchasing power. One unit of gold, say one gram, is easily exchangeable with another.

Gold is rare and therefore has a high value.

These are all properties that apply to money. That is why even the ancient Egyptians used gold as a means of payment in the exchange of goods.

In addition, there are the practical advantages. Gold does not rust, it oxidizes only with difficulty. Burying a euro unprotected is not a good idea. Gold coins last several centuries underground.

The superiority of gold is also demonstrated by the fact that central banks to this day keep the precious metal as a reserve. While FIAT money can become unusable, gold always retains its value, which is why it is always worth investing in gold.

#2 - Gold is a rare material asset

The amount of gold available in the earth's crust cannot be increased. Although a wide variety of attempts have been made, no one has yet succeeded in producing gold synthetically at a reasonable cost.

It takes a considerable amount of effort to mine the yellow metal. It takes 15 years just to open a new mine.

Copper is about 15,000 times more abundant on our planet than the precious metal. This explains why gold is so valuable.

In addition, the deposits of the precious metal are well known. No one expects huge new deposits to suddenly appear. It is different with fiat money.

Central banks can create it as needed. However, expanding the money supply devalues the currency. Another reason why you should invest in gold.

#3 - Gold protects your purchasing power

Sometimes this is doubted and reference is made to the fact that the gold price has actually fallen since 2020. This fact is correct, but does not invalidate the thesis that gold is a good inflation hedge.

In the long run, it pays to invest in gold. The Federal Reserve was founded in the USA in 1913. Since then, the US dollar has lost more than 99% of its purchasing power.

Since then, the price of gold has risen from just under $19 to more than $2,000 in 2020, a whopping 4.4% per year.

There are critics of this calculation because severe crises such as the Great Depression and two world wars fell during this period. So let's look at a shorter period.

In the early 1970s, the gold peg of the U.S. dollar was removed. The World Gold Council has calculated that since then the price of gold has risen by an average of 11% per year.

So the increase in value has been well above official inflation and above the 100-year average. And the 2022 loss?

The Federal Reserve's high interest rate policy is making government bonds attractive. However, the phase is likely to be finite. A recession is looming, in which case the Fed will have to crank up the printing press again.

Then it will become more attractive again to invest in gold. Currently, there are no signs that the precious metal will lose purchasing power in the long term.

#4 - Gold is a low-risk investment that is easy to understand

Compared to many other asset classes, gold is easy to understand. The precious metal is traded worldwide and has a transparent value. You can get comprehensive information about the supply on the Internet and at precious metal dealers.

Gold cannot suddenly become insolvent, just like a company or a state. Unlike securities and central bank money, the precious metal is not a promise of value.

If you invest in physical gold, you have the value at your home or in a safe storage.

In addition, the value of the yellow metal is not endangered by economic developments. While you need expertise for other assets, you can invest in gold and enjoy its value stability.

#5 - Tax free gold pension

Capital gains must be taxed. For this purpose, there is the final withholding tax, which is levied on pretty much all assets.

Fro example an exception in Germany is physical precious metals, the sale of which is tax-free if they have been held for at least 12 months.

If you want to sell the gold earlier, you have to pay tax on it as a personal sale transaction. Here there is a tax allowance of 600 euros.

To benefit from the tax exemption, you must invest physically in gold. This way you can build up a tax-free gold pension for financial security in old age. It is not advisable to buy securities that are based on the gold price.

They are first of all only a promise that a corresponding equivalent value in gold is available. There is therefore a counterparty risk. Moreover, in most cases the profits have to be taxed.

Another advantage of physical gold is that there is no VAT on the purchase and sale.

#6 - Gold is tangible asset that is highly liquid

Liquidity arises when an asset can be traded quickly, easily and inexpensively. If there are very many market participants who want to trade an asset, this is referred to as a highly liquid market.

The advantage is that the more buyers and sellers there are in the market, the lower the trading margin, the so-called spread. This reduces transaction costs.

Gold owners are always able to sell holdings of the precious metal due to the high demand.

At the same time, market participants can invest in gold at any time if the price seems fair to them. Compared to other hard assets, this is an advantage.

Those who want to sell real estate usually search for a suitable buyer over quite a long period of time.

Investing in physical gold is worthwhile not only for this reason. The precious metal is also considered the most important liquidity reserve on the market.

#7 - Gold can be managed anonymously by yourself

For some time now, states have been taking an interest in their citizens in a way that can be perceived as intrusive. Today, government agencies often know more about us than we do. Gold is one of the assets you can buy in cash.

However, there is an upper limit here, for example in Germany is 2,000 euros. For higher sums, the seller must be shown the identity card.

So you can also buy gold 4,000 euros in cash, but then the state is also informed about this, or you buy it in 2 tranches from different dealers.

The EU Commission would like to introduce a general limit for cash payments. In some countries it is already practiced. In Greece, only goods and services up to 500 euros cash may be paid.

Such restrictions do not exist in all countries. Interestingly, Sweden also has no upper limit above which cash payments are no longer allowed. In Germany, Interior Minister Nancy Faeser is campaigning for a ban on cash payments over 10,000 euros.

German Finance Minister Christian Lindner has so far been opposed to this. In Austria, too, there is currently no cash ceiling.

So it is still possible to invest anonymously in gold and store it at home, as far as capacities are available and you feel comfortable with it.

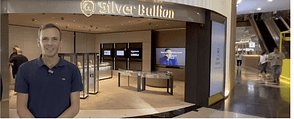

The alternative is the safe and discreet storage at specialized providers. We recommend among others Silver Bullion in Singapore, with whom we have had good experiences ourselves.

Below you can watch a video on the topic: