It is not only since the corona pandemic that countries have been trying to overcome crises by taking on high debts. The current global debt is probably the most extreme that has ever existed.

To this end, central banks keep creating new paper money without even creating new value. This will have significant consequences on wealth. A well-filled bank account will lose purchasing power through inflation.

The US Federal Reserve has already paved the way to this form of monetary devaluation by realigning its inflation target.

Owning precious metals protects against expropriation of wealth if a few rules are followed. The key is to store gold and silver properly and to look closely at ownership.

The storage in the home safe is well suited to be liquid at any time. However, you are less protected against expropriation of assets by local creditors and the home state.

Also the deposit of the domestic bank is tangible for the state and not very safe, as we will see later.

You also need to be aware of why you are buying physical precious metals. You usually do this to store assets outside the banking system. Accordingly, we don't want to store it back at the bank.

In addition to bank vaults, there are large, very secure storage facilities. They are well insured and keep your precious metal safe. However, even they cannot defend themselves 100% against government covetousness.

You should store part of your assets in a safe place abroad. In Europe, Switzerland and Liechtenstein are considered safe countries. They offer comprehensive data protection and strong protection of private property.

Switzerland and Liechtenstein are good addresses for asset protection. However, both countries are strongly intertwined with the European Union, which has had devastating effects on banking secrecy in Switzerland, for example.

Therefore, it also makes sense to move some of your assets to a safe place outside Europe. An interesting location for gold & silver storage is Singapore, which has a very strict protection of private property.

Why you should only buy

physical precious metals

The biggest and at the same time the most important advantage for buying physical gold & silver is the security. With the purchase of a gold bar you are the owner.

This then also outweighs the disadvantage compared to a certificate. Buying and storing physical gold & silver is more expensive than buying a certificate. However, certificates have a high counterparty risk.

A certificate is a debt obligation of the issuer. It confirms to the buyer a right over the value of a certain amount of gold.

The buyer of a certificate does not acquire gold. It is not even certain whether the gold exists at all and what quality it has, if it exists.

In addition, the insolvency of the issuer means that the bond can no longer be serviced. The buyer suffers a total loss. Certificates are therefore not suitable for secure asset protection.

Unlike the purchase of certificates, when you buy physical gold, the ownership of the precious metal is transferred to you. You own the bar or coin as the owner.

You can store the gold or silver wherever you want. It is your decision where to store it and how to use the precious metal.

The cost of buying, possibly making the bar (molding costs) and storing the bullion is well invested when you consider how high the risk of loss is with a certificate.

We all remember the 2008 financial crisis and this scenario can happen again at any time. If you own a gold certificate of a bank that goes bankrupt, your assets are gone.

Certificates are only suitable for short-term transactions. A certificate is a good instrument for speculating on a short-term increase in value.

Certificates can be sold again without high fees and quickly. The situation is similar with ETCs, which also only document a debt of the issuer. Although physical gold should be deposited here, in the end an ETC is also only a debt security.

Secure, long-term wealth creation therefore requires the purchase of physical precious metals.

Store gold & silver at home

In addition to the security of the storage location, you should also remember that you should be able to access part of your assets quickly.

Therefore, it makes sense to store 10 to 30 percent of your gold assets in your own home or near your apartment.

The advantage of storing at home is that it is readily available. However, there are some risks.

If you want to store gold at home, you should consider how to secure it from loss.

The best option is a safe, but even this will not protect you if you have to open it under duress. It is also important to have a reliable household insurance. You should check with your insurer what kind of safe meets the requirements.

Insurers reimburse damages according to the resistance level of the safe. If you want to store a lot of gold or silver at home, you need a safe with a high resistance level.

The installation usually requires a considerable intervention in the substance of your house. An alternative is a good hiding place to store gold.

Distribute your precious metal in several hiding places. Thieves usually have little time to break in, which means that you will rarely lose everything in a burglary.

In addition, you can also set up a fake safe with less valuable contents and hide the other safe very well.

However, there is something important to keep in mind when hiding: The hidden precious metal is usually not insured.

Bank safe deposit boxes offer an alternative way to store gold and silver. They offer a high level of protection against theft and you do not have to invest in a safe in your own home.

The bank usually charges you fees of 25 to 65 euros per year. Break-ins are rare and banks are well insured against them. The contents are stored discreetly. The bank does not know what you store in the safe deposit box. However, the state can demand a forced opening. Access is limited to bank opening hours.

A very important point why we generally advise our clients not to store precious metals in a bank:

For what reason do you buy physical precious metals? You buy it, among other things, to have value outside the banking system. What is the point of taking your physical gold back to a bank if you want to protect yourself from that very system?

Bank safe deposit boxes are good for valuable documents, certificates and other records. Not really for physical precious metals.

Another alternative is the storage at a local precious metal dealer or safe operator or private locker provider such as "Das Safe" in Vienna. You can find reputable precious metal dealers in Germany on the comparison portal Gold.de.

Store gold and silver offshore

Especially if you want to protect your assets from the state, gold & silver can be stored safely abroad.

A good place to store is a country where there is a high level of legal security. The protection of private property should be an inalienable part of the constitution.

When storing gold & silver abroad, it should be noted that you will not be able to access your assets as quickly as at your place of residence.

Ten to 30 percent of your precious metal holdings should be stored at your place of residence or in directly neighboring countries in order to remain liquid. The rest should be deposited with specialized vault operators abroad.

Choose a country where the government has little or no ability to confiscate private property.

In Europe, Switzerland and Liechtenstein offer some of the best conditions to store gold & silver.

Switzerland's reputation as an ideal place to store gold and silver is based on its legal system.

The Swiss Confederation consists of 26 partly sovereign cantons, which act as constitutional authorities. It is not possible in Switzerland for the federal government in Bern to change the constitution without the consent of the cantons.

In addition, Switzerland has a very pronounced participation of the population in political decision-making processes. It is inconceivable that the Swiss would allow the state to confiscate private assets.

It is important that the storage takes place in your plot or locker. Ownership of the stored values remains with you. This means that there is no counterparty conflict. This is also called strip custody or special custody (segregated custody).

Even if the operator becomes insolvent, the stored assets remain your property. Vault operators in Switzerland operate highly secured facilities located primarily under the airport in Zurich.

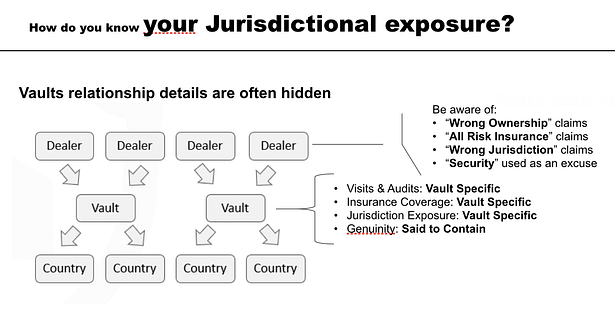

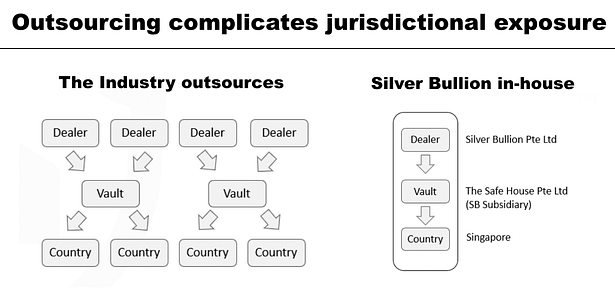

Among the operators are Brink's Switzerland and Loomis International. Here, however, you must consider the jurisdiction risk of the companies. Brinks is a US company and Loomis is headquartered in Sweden with subsidiaries in the US.

In the event of a gold ban in the U.S., this may also affect globally operating hedging companies such as these.

It is best to go with a company that combines everything in one jurisdiction. This is the case, for example, with our partner Silver Bullion in Singapore. The images below better illustrate the risks of these interactions:

In addition to strict adherence to private property rights, the country pays close attention to data protection. The vault in Triesen is one of the most secure in Europe. Like the Swiss vaults, it is insured by Lloyds of London.

Even though Switzerland and Liechtenstein are very interesting locations, the dependence of these countries on the EU must be illuminated. The exchange of information in tax matters, enforced by the OECD, has softened Swiss banking secrecy.

This example shows how important it is to diversify the locations of your assets. Hong Kong used to be a popular location for people to buy gold overseas. Due to China's ever-increasing influence on the Special Administrative Region, its attractiveness suffered.

For this purpose, Singapore, already mentioned above, is a good alternative. The city-state has a very high standard of living and hardly any crime. The legislation ensures the protection of private property. The storage of your precious metal is discreet.

At first glance, Singapore looks heavily indebted. Upon closer inspection, you learn that the city-state is highly solvent and a net creditor country!

A modern vault facility is located in the port of Singapore and is operated by Loomis International. But if you don't want to be dependent on these large corporations you can look at the alternative at our partner Silver Bullion.

Silver Bullion has its own high security vault and operates everything in-house. This means that trading and storage is only dependent on Singapore legislation without any further interactions with other jurisdictions.

The company has big expansion plans for the coming years and also offers English and German speaking customer service since October 2020.

January 2020 we were directly on site with our GoodbyeMatrix community and the founder Gregor Gregersen together with his team introduced us to the whole facility.

On site we recorded all lectures and the visit of the vaults on video and summarized them with many other materials in an exclusive summary in the GBM CLUB. Through this you will learn unique insider information, which will help you to secure your assets in the coming crash.

Picture: Sergio von Facchin with his business partners Gregor Gregersen (Founder Silver Bullion) and Jose Flores (GoodbyeMatrix Español) in Singapore

In addition, we were able to arrange a unique deal with Gregor, which allows all our GoodbyeMatrix clients and also members of the club to store and also purchase precious metals at Silver Bullion at discounted rates.

Silver Bullion's storage discount is 18.5% for gold and 15.8% for silver (this status can also be applied to existing accounts). In addition, your account will be upgraded directly to Tier 3, allowing you to purchase precious metals at a discount. This way you can already significantly reduce your storage costs, which fully compensates for the small investment in the CLUB with many additional contents and benefits.

As with other providers in Switzerland and Liechtenstein, you can visit Silver Bullion's facility at any time and check that your gold is complete.

This is an important point because we have seen other vault operators who do not make it so easy for you to visit the vaults. This is always a big warning sign for me.

Always store independently

from the banking system

If you want to store gold safely, you have to do without the banking system. If there is a financial crisis, there can be a bank run.

The result is that banks can no longer meet the demand for cash. They have to close down, which can also block access to safe deposit boxes.

If the government comes up with the idea of seizing assets, your gold is gone, as they will be among the first to investigate banking institutions and their safe deposit boxes.

Therefore, avoid having your precious metal assets held by a bank.

Another problem: Although the contents of your safe deposit box remain discreet, its existence is usually not a secret. In most cases, the rental of a safe deposit box is linked to an account.

In addition, you can never check whether a bank employee examines the contents.

This means that it is not possible to rent a safe deposit box anonymously. This means that the state also has access to your assets in a crisis situation. It can close banks by decree at any time and thus prevent your access to the safe deposit box.

How such an expropriation can look like, the Greeks and Cypriots have experienced painfully in the euro crisis. If you want to deposit a part of your assets near you, storing gold at a precious metal dealer or professional vault operator at home and abroad is therefore safer.

And as mentioned above, you buy precious metals to hold an asset that is independent of the banking system. To store it again at a bank would make your plan null and void.

Buy gold abroad

Buying gold abroad is worth considering for many reasons. Unlike other precious metals, the purchase of the yellow metal is VAT-free throughout the EU.

However, this only applies to bars if the fineness is at least 995/1000. For coins, the fineness must not be less than 900/1000.

They must not have been minted before the 19th century and must be legal tender in the country of minting.

The legislator sees gold as a store of value. The increase in value remains tax-free as long as you hold your precious metal for at least one year.

When buying silver and platinum, on the other hand, you have to pay sales tax in any case.

Buying gold abroad makes sense for other reasons. If you want to use gold as asset protection, it makes sense to store a large part of it abroad.

As already mentioned, it is not certain that states will not resort to harsh measures in a financial crisis. The USA survived the Great Depression by expropriating its citizens by decree in 1933. The government summarily banned the ownership of gold.

If you want to bring gold from Germany to a foreign country outside the EU, you may have to declare it to customs. Customs regulations require you to declare cash and equivalent means of payment worth more than 10,000 euros.

Gold, silver and platinum are considered as equivalent means of payment. Customs not only wants to know how much gold you are carrying. You have to declare where the precious metal comes from, who owns it and what you want to use it for.

With this the anonymity of your possession is lost. However, this is usually already the case, because in Germany you may buy gold only in the value up to 1,999 euros without having to identify yourself. This is the gold value of about one ounce. Here it can make sense to buy your precious metals in a neighboring country.

So there are some points that make it make sense to buy and store gold abroad.

Is it cheaper to buy gold and silver abroad?

Prices on the main gold markets hardly differ and are set internationally by the gold fixing in London. Primarily, the price differences are limited to production and shipping costs or premiums of the dealer.

Buy gold cheap abroad - you should be skeptical about such offers. Since there is no VAT on gold in the EU, it is not possible to save money abroad from this point of view.

Very cheap offers could indicate poor quality or an unfavorable counterparty risk for you. It makes sense to purchase precious metals at the intended storage location from a reputable dealer to keep shipping costs or duties low.

In addition, buying in Singapore, for example, is anonymous and can also be done locally using cash. This shows that buying abroad can be quite profitable. However, the advantages are not so much in the purchase price.

The situation is different for silver or platinum. These metals are subject to VAT in the EU and Switzerland. In Singapore, very pure investment bars and coins are tax-free if they are certified accordingly.

However, you can also purchase silver and platinum tax-free in Germany if the trade takes place in a bonded warehouse. Degussa, for example, operates such a warehouse.

As long as you do not have the precious metal, which also includes palladium and rhodium, delivered to the EU, no sales tax will be charged.

You can also sell your assets tax-free at any time within the bonded warehouse.

Disadvantage: The bonded warehouse is located on German territory. This means that it does not meet the requirement to diversify the location of your assets.

Of course, such bonded warehouses also exist in other countries.

Image: Sergio von Facchin in "The Safe House", the Silver Bullion vault in Singapore.

Make sure that you

own the precious metals

When storing precious metals, there are two overriding ownership relationships. Either you are the owner or the creditor.

Make sure that you are the owner of your precious metals!

If you are only a creditor of a vault operator, there is a high counterparty risk that can lead to the loss of your assets.

Many vault operators act as debtors to you. You store gold for which you get a receipt that the storage facility or provider owes you a certain amount of the precious metal (collective custody / allocated).

Storage is cheap. This is mainly because the vault operator does not provide individual parcels for owners.The bars are owned by the operator (hopefully marked as special assets) and you have a share in it, so there is no need for elaborate allocation to individual owners.

For you and your assets this results in a huge risk: If the operator of the vault has to pay obligations, he serves them from the stored assets. In the event of insolvency, all claims will be met from the remaining assets.

If the claims cannot be serviced in full, the creditors will be left empty-handed in whole or in part. This would become problematic especially if the provider has not marked the stored assets of his clients as special assets.

Another problem can arise in the event of fraud on the part of the provider. If the provider has sold less precious metals in collective custody than stated or to his clients, then all creditors must be served from the remaining precious metals.

Remember: You are one of these creditors. There is only secure asset protection if you remain the owner and the bar remains in your private possession. Thus, the lending of your property would also be illegal and it must not and cannot be entered in the balance sheet of the dealer or vault operator.

If you give the order for storage abroad, it must be ensured that your gold is stored separately. After all, it is your property and not that of the storage service provider. This form of storage is also known as segregated storage.

You alone must be able to access the precious metal. You receive an invoice for the storage and pay for the space in the vault.

By purchasing a bar, ownership is transferred to you and it can be clearly indicated that the item belongs to you by showing the bar's serial number on the invoice.

Coins without serial numbers are often shrink-wrapped in plastic bags and marked with a unique serial number that can be assigned to you.

In addition to high transparency, there is little counterparty risk. Even if the vault files for bankruptcy, the gold remains your property. There is no risk of your precious metal being debited by the vault operator.

For the operator, the implementation of such a storage involves some effort. He must create individual plots, which he rents or sells. In addition, there is the complex registration of each bar as the property of the customer.

One provider who works according to this secure principle is our partner Silver Bullion in Singapore.

In the Silver Bullion vault (The Safe House) you rent a space, the barre or coins get their own parcel via the serial number or a specially generated one (for coins, as they have no serial numbers) and is clearly identified on the purchase invoice of the precious metals.

This ensures that the precious metals become 100% your property and no longer belong to Silver Bullion.

You can sell, lend or have your property delivered to your home at any time. Others have no access to your assets.

This approach makes storage a bit more expensive than other providers, but you have clearly regulated ownership, which dramatically reduces your risk.

With Singapore as an extremely secure legal framework far away from the EU and USA an optimal location for your asset protection!

As a GoodbyeMatrix client and also as a member of our CLUBS you can store and buy your precious metals at Silver Bullion at discounted rates.

The discount for storage costs at Silver Bullion is 18.5% for gold and 15.8% for silver. In addition, your account will be upgraded directly to Tier 3, so you can buy precious metals at a discount. This way you can already significantly reduce your storage costs, which fully compensates for the small investment in the club with many other contents and benefits.

3 interesting countries

to store gold & silver abroad

In Europe, Switzerland and Liechtenstein are considered safe storage locations for precious metals. The countries are characterized by a high level of legal security and economic stability.

Switzerland's success is based on respect for the will of the people, who repeatedly influence politics on crucial issues.

Private property is protected by the constitution. Any abolition of this constitutional right requires the consent of the people. It is hardly to be expected that there will ever be such a vote.

The Principality of Liechtenstein made it from a bankrupt to a prosperous country within a few decades after the Second World War. The basis of this rise was the reliable policy of the Princely House, which built a powerful financial center in the middle of the Alps.

The basis of success is the security of private property. Since Liechtenstein's constitution does not provide for a state of emergency, there is also no basis for compulsory expropriations.

Singapore has similar advantages to offer. The city state impresses with its simple tax legislation. There is no value-added tax or capital gains tax on precious metals.

In addition, there is a high degree of legal security for private property, which is also protected by the constitution.

Store gold and silver in Switzerland

In Switzerland, the free development of entrepreneurship has a long tradition. Regulation by politics hardly takes place. The power of the central government is limited by the influence of the cantons and by direct democracy.

The country has resisted external pressure throughout history. Switzerland defended its sovereignty and neutrality against all external pressure.

The self-image of the Swiss prohibits the exercise of power from the top down. Decisions are made at the lowest possible level.

One of the most important means of democracy in Switzerland is referendums, the results of which are binding on politicians. This system has also proven its worth in the recent past, when the EU made Swiss membership in the EEA subject to strict conditions.

In the process, the Swiss like to surprise their neighbors with very pragmatic decisions. The Swiss voted against increasing the current six-week paid vacation and against membership in the EU.

The unconditional basic income demanded as a panacea in other countries also did not stand a chance in Switzerland.

In addition to this political pragmatism, the outstanding economic situation is a major argument for storing gold in Switzerland. Security is provided by the prudent budgetary policy of the Swiss Confederation.

In 2018, the Confederation's gross debt was below 100 billion Swiss francs for the first time in a good 20 years.

Switzerland's policies are guided by economic pragmatism. Innovations find an ideal environment in the Swiss Confederation.

When cryptos emerged and many European governments voiced their concerns, Switzerland quickly opened up to the new technology. The "Crypto-Valley" was created in the canton of Zug, which has a high growth potential. The region thus received an important impetus for further development.

Internal and external security is also a decisive criterion. Neutrality and a foreign policy of peaceful coexistence are the basis for a peaceful environment.

The fact that more than every second household has a weapon to defend its homeland also gives a high sense of security. It is appreciated not only by citizens but also by investors.

To confiscate precious metals, the Swiss government would have to change the constitution. Since in this case the people would have the final say, such a scenario is hardly imaginable.

This means that Switzerland will remain a safe place to store gold in the future.

Store Gold & Silver in Liechtenstein

The Principality of Liechtenstein has undergone rapid development since the end of the Second World War. Today, it is a modern, high-performance financial center that enjoys an excellent reputation worldwide.

The country is ruled by one of the oldest noble families in Europe. Reliability for business and finance have helped Liechtenstein achieve great renown.

The princely family is well connected in this regard. To this end, for example, they founded the European Center of Austrian Economics Foundation. It is an innovative think tank that stands for personal responsibility, individual freedom and limited government power.

The Principality is one of the few countries that does not have emergency legislation. This is a great advantage when it comes to gold storage in Liechtenstein.

Foreclosures as a result of economic crises or political unrest are practically impossible to implement.

Liechtenstein is a constitutional monarchy, but with a strong participation of the inhabitants. The prince and parliament share power, with the monarch having far-reaching veto rights.

He must use these with great tact, however, because the people have the vested right to abolish the monarchy at any time. In addition, citizens can launch a no-confidence initiative against the prince.

Only 1,500 people need to join the initiative to initiate proceedings against a decision by the monarch. The current prince reaffirmed the traits of Liechtenstein politics in the book "The State in the Third Millennium".

In it, he advocates limiting the power of government and preserving freedom of speech. Moreover, the writing is a plea for free trade.

In addition to the protection of private property, the country attaches great importance to the preservation of privacy and the economic independence of its inhabitants.

Externally, the principality appears sovereign. Reliable national defense is provided by the Swiss army.

Another argument in favor of Liechtenstein as a place to store gold are the solid state finances. For years, the country has been generating a budget surplus, which gives it room to maneuver in the event of a crisis. The country is not in debt.

How flexible and adaptable the principality is can be seen in the crypto revolution. The country opened up to the new technology very early on and is now a leading location in Europe, along with Crypto Valley in Zug, Switzerland.

Hint:

GoodbyeMatrix can help you open private accounts in Liechtenstein, but also has solid partners for precious metal storage with a private vault operator.

For segregated storage in your own name, however, a minimum of 150,000 CHF to 250,000 CHF of precious metals must be stored. If this is too much for you, you can also have smaller amounts stored in collective custody.

If you are interested in a segregated storage in Liechtenstein with our partner, please contact us personally. Please only contact us if you can really meet the minimum requirements and if you have the money ready to invest.

Store Gold & Silver in Singapore

The city state is one of the leading nations when it comes to the protection of private property rights.

The non-existent capital gains tax and value added tax on precious metals speak in favor of storing gold in Singapore and acquiring bullion.

Since independence in 1965, state founder Lee Kuan Yew worked on the success of the island state. The foundations of the success are the stability and cohesion of the society as well as the ambition of the Singaporeans.

From the beginning, the state doctrine was to invest in the future and to provide for crises, but also for future generations.

In just a few decades, a British goods transshipment center developed into a modern business location. This economic miracle benefited from the favorable strategic location on the route of many trading nations and close to China.

In addition, there is a simple and investor-friendly tax system and a transparent legislative framework.

The political system is considered extremely robust and the national economy is among the most efficient in the world. GDP has been growing much faster than the global average since the state was founded.

While Singapore has achieved annual GDP per capita growth of 5.1 percent since 1960, the world average is just 1.9 percent.

The legal system is based on very low bureaucratic hurdles for business, and court proceedings are swift.

Compared to Switzerland and Liechtenstein, however, Singapore has only limited civil liberties. Society is governed "from the top down.

Ultimately, however, it was the strong leaders who ensured the rapid rise of the city-state.

And so it is logical that rich people with assets of more than 30 million U.S. dollars like to choose Singapore as their center of life. This is the conclusion of the annual World Ultra Wealth Report.

Skeptics like to accuse Singapore of the fact that the island has not yet had to prove itself in a crisis.

However, this assessment is wrong. Singapore is surrounded by large neighbors who watch the country's success with suspicion.

Indonesia never forgave the island for sentencing three Indonesian sailors to death for perpetrating a bombing in Singapore. Malaysia has tried to force reunification, for example, by threatening to block badly needed water supplies.

So far, Singapore has always come out of these challenges stronger.

While capital controls and taxes on the rich dominate debates in the West, this is unthinkable in the city-state. The government advocates entrepreneurial freedom as an inalienable right.

In Europe, politicians are increasingly responding to the challenges of the day with centralist efforts. Protection against restrictions on economic freedom is a constant struggle for the Swiss and Liechtenstein citizens.

The physical distance to Europe could ultimately be a decisive advantage of Singapore. An excellent protection for your assets is the storage of your precious metals in a personally assigned parcel in the safe house of Silver Bullion.

The company, which is firmly rooted in Singapore, ensures that your property is kept strictly separate from SilverBullion.

You retain your authenticated ownership rights when you deposit. Your assets reside in your parcel and are therefore clearly attributable to you.

The company procures and authenticates precious metal and provides you with the appropriate storage space in clearly defined parcels.

If liquidity is needed, the repurchase can also be handled by Silver Bullion. The company is debt free and has assets that would allow it to survive for ten years without selling anything.

Silver Bullion is a member of the Singapore Bullion Market Association. KPMG and The Business Times awarded the precious metals custodian as the 33rd-best private company.

The biggest advantage is that you remain the owner when you store the precious metal. This is where Silver Bullion differs from many other vault operators and from banks, where you only receive a depository receipt for a certain amount of gold.

This way you become a creditor but not an owner. We have described the effects above.

The precious metal in the parcel, on the other hand, is clearly defined as your property and cannot go into default. Integrated is the S.T.A.R. system that manages the parcels. The stored assets are audited and are fully insured.

You can store your bars for the long term, resell them or use them as collateral for peer-to-peer loans, allowing you to lend your assets. This way, you retain full control over your property at all times.

Create now optimal asset protection with precious metals through insider knowledge

As you could already read in the last section about Singapore and Silver Bullion, the company and the location are a high-end solution for your asset protection.

January 2020, we were with the GoodbyeMatrix community directly on the spot and let the founder Gregor Gregersen and his team show us the entire premises. In 2023 I visited Silver Bullion again.

There, we put everything through its paces and got impression of this solution ourselves.

I was particularly struck by the fact that the company is extremely transparent and that every critical question was answered. We were also shown all the premises and the entire group was allowed to enter the vault.

Other companies refuse to allow us to enter the vault or it is extremely difficult to organize this.

When visiting the vault, I created an impromptu audit and gave the staff a random lot number.

Thanks to the sophisticated S.T.A.R. storage system, we were standing in front of the silver bar after just a few minutes and everyone could see for themselves that it really was stored in the vault.

The entire vault visit, the test unit for precious metal verification and the highly exciting lectures from the founder Gregor Gregersen with insider information we have recorded on video.

These videos can be unlocked for a very manageable investment in our club and you can make your own impression of the company and the location Singapore.

Additionally, as a GoodbyeMatrix client and also as a member of our Club, you benefit from discounted conditions for the storage and purchase of your precious metals at Silver Bullion.

The discount for storage costs at Silver Bullion is 18.5% for gold and 15.8% for silver. In addition, your account will be upgraded directly to Tier 3, so you can purchase precious metals at a discount. This way you can already significantly reduce your storage costs, which fully compensates for the small investment in the club.

So if you are thinking about storing your precious metals in Singapore and with Silver Bullion, then I can definitely recommend you to invest in our Club.