This article will explain why storing gold in Singapore is a safe option. Singapore is a success story that many people are unaware of, and it owes much of its success to the leadership of Lee Kuan Yew, among others..

From a third world country some 50 years back, it is now one of the richest city-states in the world and is one of the cities that hosts the most ultra-rich people (UHNWI).

Although Singapore has a less impressive reputation when it comes to individual freedoms compared to Switzerland and Liechtenstein (other interesting locations for wealth preservation), it still attracts many ultra-rich people.

Singapore is celebrated worldwide as an economic miracle and attracts corresponding individuals as a consequence.

The city-state is located at a strategically significant crossroads of the world's most important shipping routes and additionally relatively close to China. This gives the country unique geographical advantages.

It is:

The far distance from western powers like Europe and also the USA, makes Singapore as a rich and transparent jurisdiction ideal for safe storage of assets like gold & silver.

Why store gold safely in Singapore?

In addition to Singapore, Luxembourg, Liechtenstein and Switzerland are particularly well known as locations for asset protection.

Singapore does not charge capital gains tax or VAT on investment precious metals, and has an impressive track record of property rights compliance.

Let's take a closer look at Singapore and why first impressions of this country may be deceiving. Despite being one of the most indebted countries on the planet, there are important reasons to consider keeping some of your assets in Singapore.

Does it make financial sense for Singapore to have such a high level of debt?

Some international reports refer to Singapore as a country with high public debt. These include the CIA Public Debt Factbook and the World Economic Forum report.

Some are puzzled as to why this is so, given that the government maintains a balanced budget. Some ask if it makes financial sense to have such a high debt level.

The answer is "yes." This situation makes financial sense. This is because the reports only refer to gross debt. If you include Singapore's assets, it has no net debt.

In the case of Singapore, outstanding bonds include "Singapore Government Securities," "Special Singapore Government Securities," and "Singapore Saving Bonds," which are not issued.

Instead, all borrowing proceeds from these are invested.

These borrowings are thus secured by assets.

Investment income generated from these assets is more than sufficient to cover the cost of servicing the debt.

The Singapore government has a strong balance sheet, with assets significantly exceeding liabilities.

This makes Singapore a net creditor country rather than a net debtor country.

Wealthy and stable

Singapore is a multicultural English-speaking city-state in Southeast Asia.

Despite a lack of natural resources, Singapore went from a Third World country 50 years ago to the country with the third highest per capita income in the world.

To understand how Singapore transformed from a third-world country to a first-world one, it is recommended that you read "From Third World to First: The Singapore Story" by Lee Kuan Yew, the former Prime Minister and founder of modern Singapore.

The city-state has virtually no crime or corruption, and despite low taxes, it has always run budget surpluses.

It is the only Asian country to be rated AAA by the major rating agencies.

"The Economist" ranks Singaporeans with the best quality of life in Asia, and today's Singapore is socially very stable, as well as a cultural bridge between Asia and the West, with English being the most important of four official languages.

The country has a welcoming attitude toward foreign investment. Singapore's economy is business-friendly with a free flow of capital.

Singapore's foreign exchange reserves are managed by three reserve management entities / sovereign wealth funds: "Monetary Authority of Singapore", "GIC Private Limited" and "Temasek Holdings" with a total holding of at least USD 416 billion (Apr. 2023) or equivalent to USD 76,000 per citizen.

The Singapore government is exceptional in that it does not borrow to finance its budget.

It operates on a balanced budget and repaid Singapore's last external debt in 1995.

However, the government borrows to provide a local risk-free benchmark interest rate, support a domestic bond market, and provide a guaranteed interest rate return for the country's self-funding CPF pension system.

Approximately $350 billion is borrowed for the above purposes and, in turn, invested in higher-yielding, unspent liquid assets.

Thus, Singapore has no net debt, but a number of publications, including the CIA World Factbook, have misrepresented gross debt and indicated that Singapore is highly indebted.

Now that you are aware of Singapore's debt situation, let's look at other important points in favor of Singapore as a location for asset protection like storing gold!

Well defended and neutral

With a defence budget twice that of neighbouring countries, an air force comparable to Germany's, one of the most modern militaries in the world, and over one million active reservists, Singapore is very well protected.

The Singapore Armed Forces have bases in a dozen countries, including Australia, Thailand, New Zealand, India, Taiwan, and the United States. This enables them to spread their military equipment and training facilities, particularly for the air force.

Singapore uses a Swiss-style "total defense" doctrine that encompasses military, civil, economic, social, and psychological defense, and even has a thriving defense industry.

For example, the U.S. Navy is currently evaluating 16 Terrex II amphibious fighting vehicles built in Singapore. These vehicles could become the primary ACV for the USMC.

Singapore's foreign policy aims at neutrality and maintaining friendly relations with all countries.

Singapore is a member of several regional defense treaties and maintains excellent relations with global powers such as the U.S., China, India, and Russia.

Singapore is also the smallest country in Southeast Asia, but has one of the world's most important ports, refineries, logistics centers, and financial centers, making its independence strategically important to major trading powers that view Singapore's stability as critical to global trade.

According to my statistical analysis of "The Countries with the Highest Security of Supply," Singapore ranked 37th out of 106 countries worldwide that were examined for security of supply.

Ideal for storing gold and other assets

Former Prime Minister Lee Kuan Yew, the architect of Singapore's growth, once said that if he had to choose one word to explain Singapore's success, it would be "trust.”

Singapore has no natural resources, so its wealth was built through good governance, low taxes, and a strong legal system to protect private property (all of which are currently lacking in many European countries).

These conditions attracted thousands of multinational companies to locate their regional headquarters, trading, manufacturing and research and development (R&D) facilities in Singapore to take advantage of its optimal business conditions, English language and well-educated workforce.

Singapore's prosperity is built on and depends on maintaining conditions such as free markets, meritocracy, the right to progress, and private property. It is important to champion these values in order to continue Singapore's success.

If Singapore were to betray these principles, it would be like committing economic suicide. The government is well aware of this fact.

Therefore, Singapore will protect these principles to a much higher degree than other jurisdictions. It is unlikely that Singaporean courts will require the enforcement of sweeping foreign nationalizations of Singaporean private property.

There are no capital gains taxes, sales taxes or customs duties on investment gold, silver or platinum precious metals in Singapore.

Investment precious metals are free to move and are not subject to import/export restrictions or capital controls.

In addition, under Singapore law, tangible investment assets are not financial instruments and therefore are not subject to the type of international reporting requirements typical of financial instruments (e.g. automatic exchange of information).

Here's an important note for you: If you store physical precious metals in Singapore, they aren't subject to the automatic exchange of information (CRS, AEOI) like bank deposits in many jurisdictions.

Singapore also participates in the CRS agreement.

That's why Singapore's success formula is ideal for secure gold storage

Singapore stands out due to its government's ability to implement pragmatic, long-term policies. This results in highly efficient institutions and enables people to enjoy the fruits of their labor more than in other countries.

Singapore's success and consistent policies have created an implicit trust in the government among its residents.

Lee Kuan Yew, Singapore's longest-serving prime minister, summed it up by saying:

"If I have to choose one word to explain why Singapore has been successful, it is "trust"".

When China needs international investors, it often looks to Singapore as a partner because it knows that investors are much more likely to invest in a project in which Singapore is involved.

Trust is both the product and the key to Singapore's success.

Singaporean politicians continually convey to the nation the need to improve in order to maintain this seal of quality.

It is an important reason why thousands of global companies have their headquarters in Asia and their R&D departments in Singapore.

Singaporean policymakers are pragmatic, capable planners who must fight on their merits first and foremost to move forward.

The spirit of Singapore is to overcome adversity and make it a center of strength and profit.

The government is very well endowed with $76,000 net reserve per capita, which is the highest in the world and remains the only Asian country with a AAA rating by all major rating agencies.

Singapore's sovereign wealth funds are among the largest in the world and Singapore is the largest single foreign investor in China.

In 2016, the Wall Street Journal ranked Singapore as the second freest economy in the world.

The island state is still considered by the World Bank to be one of the easiest places to do business.

Singapore is also ranked as the 7th least corrupt country by Transparency International.

Despite its size, Singapore is the third largest financial center in the world and one of the major exporters of refined oil.

A major tourist destination, three tourists visit Singapore annually for every local.

Gigabit internet connections are becoming standard for households and their medical and education systems are world class.

People also live an average of 4 years longer than in the United States (according to the World Health Organization).

Members of Parliament meet with citizens in weekly "meet the people" sessions to address issues such as trivial complaints, feedback on unnecessary bureaucracy, and maintaining the spirit of "we must do better."

I've never seen a government more responsive to the complaints of its citizens.

It explains Singapore's remarkable cohesion, openness and extremely low crime rate.

How this all affects gold storage....

Students of history know that gold nationalisations have happened before.

When the next major currency crisis occurs, there could be political pressure from heavily indebted countries to repatriate gold and impose capital controls.

If these countries were to nationalise gold, what should happen to gold held in Singapore by citizens of these countries?

Singapore, under its own rule of law, will likely determine that private property is protected and that foreign jurisdiction to seize gold does not extend to Singapore.

This response would be consistent with protecting Singapore's most valuable assets: the rule of law and investor confidence.

This breach of trust could spell economic disaster for Singapore.

This is why Singapore is such a good location to store physical gold and silver as insurance against tomorrow's crises.

It should be noted that while Singapore would be a great jurisdiction for gold in such crisis events, in practice, vault operators and intermediaries would also have to choose whose rules to follow and could resort to force majeure clauses in their storage contracts in such situations.

Store gold safely in Singapore

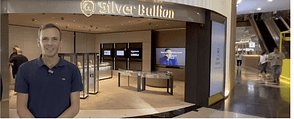

This is exactly why we work with Silver Bullion, because for just such an event, the company has built the "Nationalization Event Protection Clause" into their contracts, which you can choose to activate for protection.

Silver Bullion's S.T.A.R storage system (SB) was designed from the outset to have no material risks in the United States or Europe, and to fall only under the jurisdiction of Singapore.

STANDARD INDUSTRY: its a complex web of contractual, counterparty and jurisdictional risks.

Silver Bullion is:

In practice, this means that SB does not recognize the authority of foreign courts and does not have significant assets outside of Singapore with which to exert pressure. As customers own parcels of land as property, it would be illegal and considered theft under Singapore law to transfer customers' property to a third party, even if the third party is enforcing a U.S. nationalization order. The Safe House subsidiary also operates solely in Singapore, ensuring that this legal clarity is not compromised.

In addition, customers can activate the nationalization event protection clause. When customers activate this feature, stocks are frozen in the event of a nationalization event. No more remote orders will be accepted if it is determined that a nationalization event has occurred in the customer's country. The clause prevents precious metals from being repatriated in a nationalization event, even if vault operators are instructed to do so.

If you wish to manage your holdings or dispose of them, you would have to fly to Singapore and send them from there to your home country yourself. This clause ensures that you would not be liable to prosecution. Finally, you may cooperate with your home government and disclose to them everything you have in precious metals in Singapore.

However, you would not be able to sell or ship precious metals from your home country. You must travel to Singapore in order to dispose of your assets. Of course, this clause is only valid in the event of nationalization and if it has been activated. Otherwise, you can always dispose of your precious metals remotely!

In summary, these are the interesting advantages: